Looking into the recent take-private activity from Thoma Bravo, what it means to those respective verticals, and the implications for middle-market M&A activity in the near-term

Read MoreAn overview of the four key phases of a broadly marketing M&A process

Read MoreDiving into how Private Equity has become a staple in the Technology M&A environment.

Read MoreA look into recent M&A history for Canadian tech, and the sectors driving activity.

Read MoreAnalyzing the story of Plusgrade, from inception to the present day.

Read MoreAnalyzing how Private Equity investment has impacted the technology M&A landscape.

Read MoreRecapping the results from our bi-annual CEO survey.

Read MoreRecapping the results from our bi-annual PE survey.

Read MoreRecapping the results from our bi-annual VC survey.

Read MoreThe second part of the Peerscale poll results, where we dive into the key insights and takeaways concerning M&A inbounds.

Read MoreIn June 2024, Canadian tech executives provided insight to how they’re handling M&A inbounds in an exclusive Sampford poll stemming from the Peerscale annual retreat.

Read MoreMergers and acquisitions (M&A) involve choosing between asset and equity deals, each with distinct advantages. Understanding these differences is crucial for a successful M&A process.

Read MorePrivate equity is a form of financing where pools of capital are used to invest in or acquire privately held companies across various industries. The private equity model has been around for decades and has gained investor interest due to its history of high returns and unique risk profile.

Read MoreSoftware Initial Public Offering (“IPO”) valuations have skyrocketed over the past decade, climbing 430%+ since 2010, with a majority of the gains realized over the past 2 years. On the other hand, Venture Capital (“VC”) investments in the broader software space have always commanded elevated valuation expectations.

Read MoreOver the past decade a new term in the alternative investment space has seen quite the increase in usage – growth equity (GE). Falling under the umbrella of private capital, growth equity investments are often seen as a middle ground between traditional venture capital and private equity strategies.

Read MoreWhen Covid-19 hit North America in earnest in mid-March, its no secret that the M&A market saw a dramatic slow-down in activity. Three months on, and the M&A market has shifted dramatically again, this time for the better.

Read MoreCovid-19 has had a dramatic impact on the overall markets and especially the venture capital and M&A markets. And while the market has bounced back significantly from recent lows, many clients are asking what this means for the private markets like M&A and raising VC capital. As such, we keep getting questions from various software companies on what is the best course in these challenging markets.

Read MoreSince the markets began their freefall in mid-February, the global financial community has been looking to history for answers as to what comes next and how to best prepare for uncertainty.

Read MoreBut what makes Canada a great country for investment? With the explosion of private capital availability in global capital markets over the last decade, Canadian technology companies have attracted venture capital investment at an annualized growth rate of 23% per year, far surpassing our southern neighbor’s growth rate of 15% over the same period.

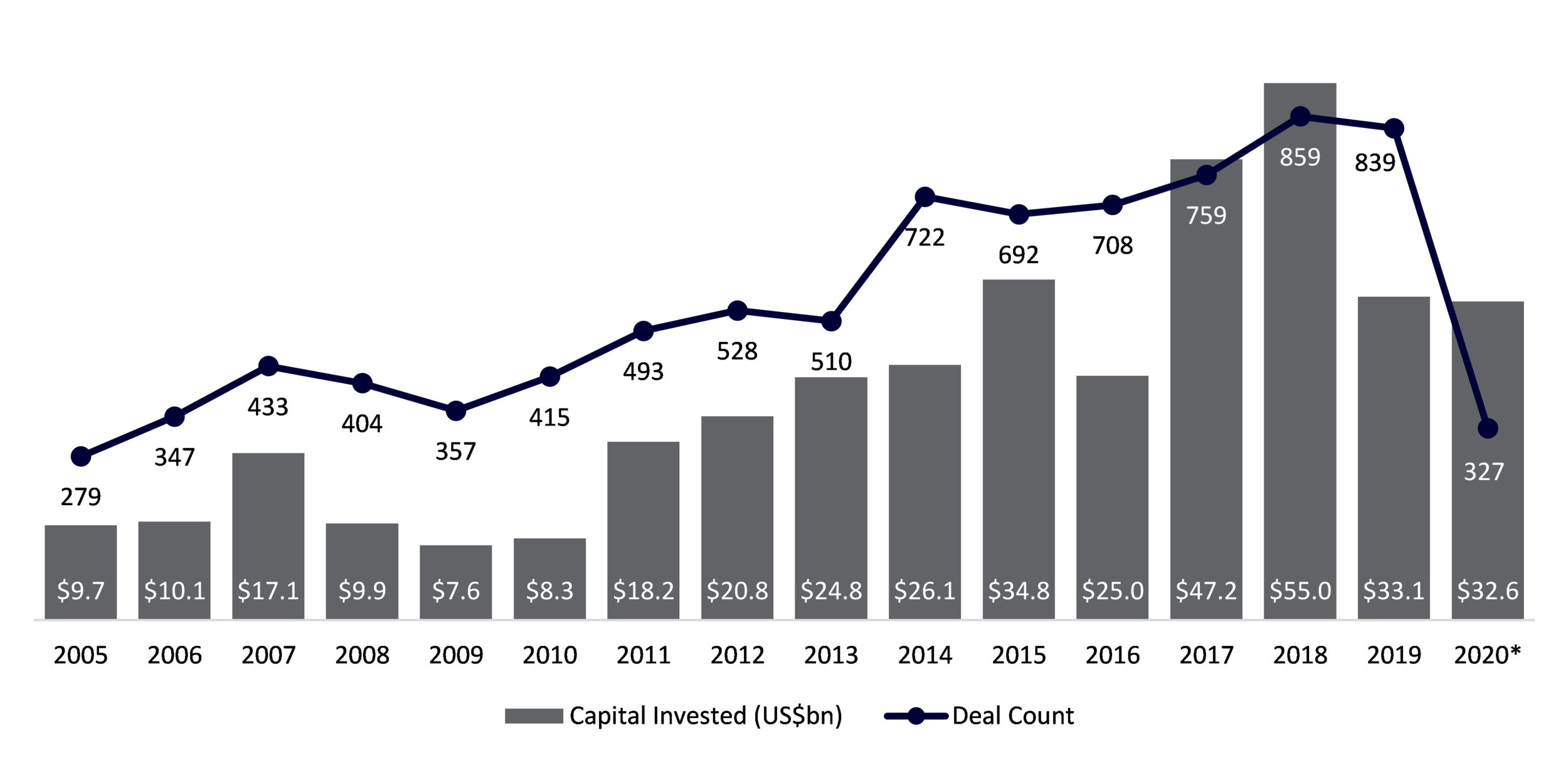

Read MoreOne sector where private equity has become more active over the past decade has been Software. Private equity’s share of total software M&A deals has nearly doubled from 2010 to 2019 and now accounts for over a third of all Software deals.

Read More