Over the past decade a new term in the alternative investment space has seen quite the increase in usage – growth equity (GE). Falling under the umbrella of private capital, growth equity investments are often seen as a middle ground between traditional venture capital and private equity strategies.

Read MoreWhen Covid-19 hit North America in earnest in mid-March, its no secret that the M&A market saw a dramatic slow-down in activity. Three months on, and the M&A market has shifted dramatically again, this time for the better.

Read MoreCovid-19 has had a dramatic impact on the overall markets and especially the venture capital and M&A markets. And while the market has bounced back significantly from recent lows, many clients are asking what this means for the private markets like M&A and raising VC capital. As such, we keep getting questions from various software companies on what is the best course in these challenging markets.

Read MoreSince the markets began their freefall in mid-February, the global financial community has been looking to history for answers as to what comes next and how to best prepare for uncertainty.

Read MoreBut what makes Canada a great country for investment? With the explosion of private capital availability in global capital markets over the last decade, Canadian technology companies have attracted venture capital investment at an annualized growth rate of 23% per year, far surpassing our southern neighbor’s growth rate of 15% over the same period.

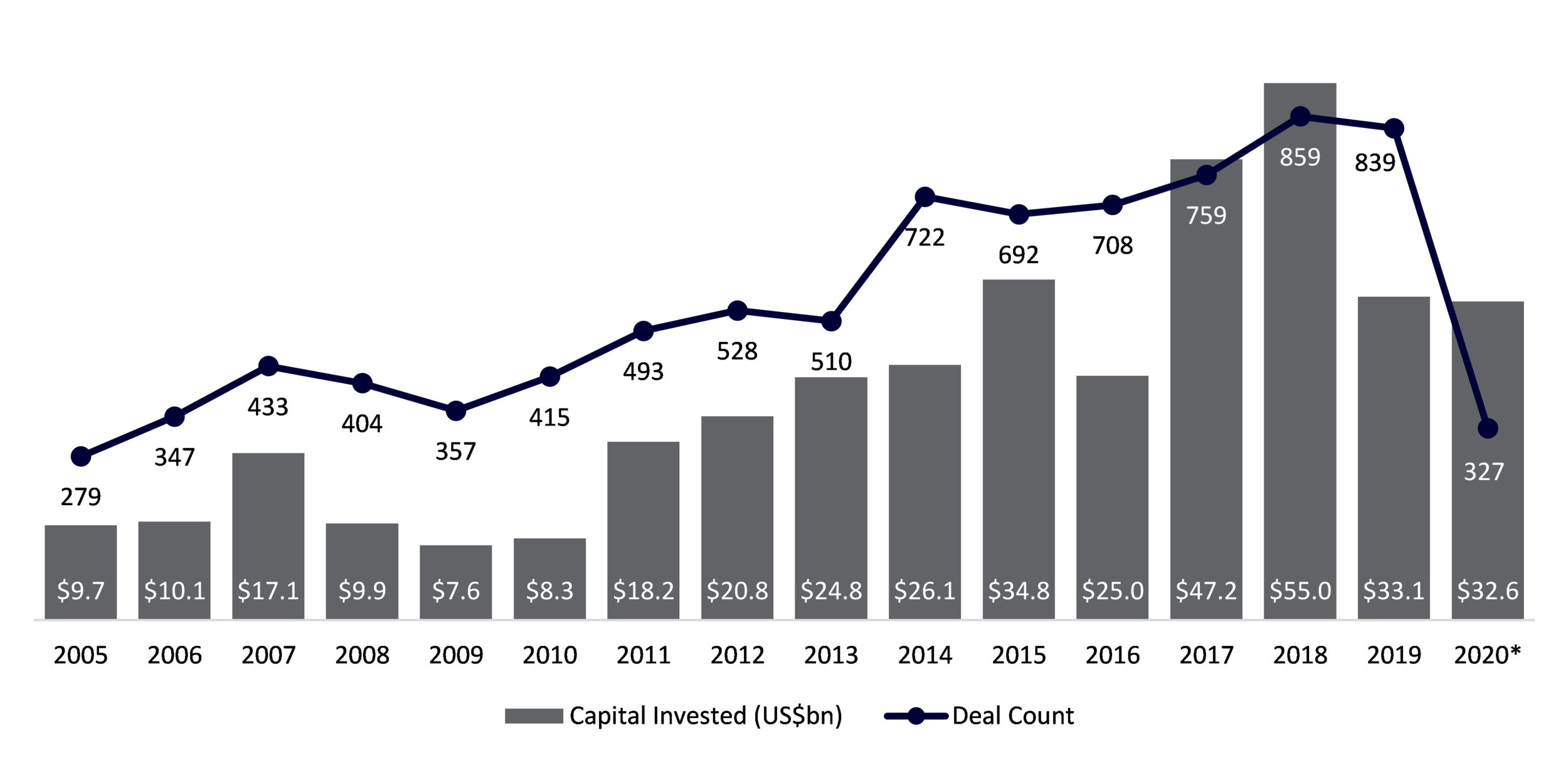

Read MoreOne sector where private equity has become more active over the past decade has been Software. Private equity’s share of total software M&A deals has nearly doubled from 2010 to 2019 and now accounts for over a third of all Software deals.

Read MoreOn the back of a record year for M&A and another strong year for the equity markets, we thought we would share our predictions for 2020 in this short blog post.

Read MoreWhile it's been encouraging to see some of the big Venture Capital (VC) investments into Canadian technology companies over the last few months, the headlines cover-up a much more alarming trend. If you look at dollar volume of VC investments as a % of the activity in the US, the trend has actually been in the opposite direction - i.e. there is less money being invested today in Canada as a % of the money that's being invested in the United States that there was in 2012.

Read More