Venture Capital’s Lure to Canadian Technology Companies

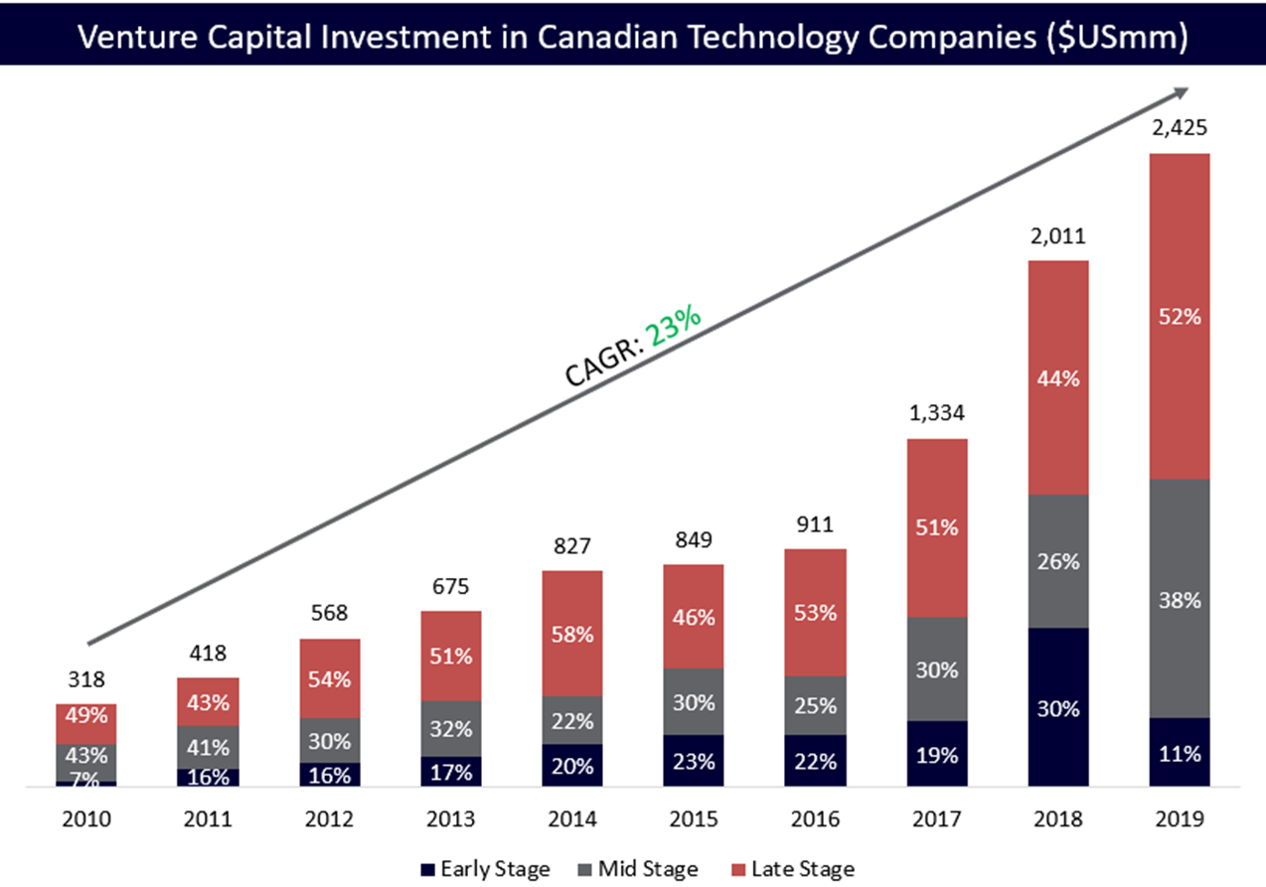

Call us biased, but we think Canada is a pretty great country. Rugged, untouched terrain, individual freedom and a sense of community that can only be forged from months of co-existence in cold winters. But what makes Canada a great country for investment? With the explosion of private capital availability in global capital markets over the last decade, Canadian technology companies have attracted venture capital investment at an annualized growth rate of 23% per year, far surpassing our southern neighbor’s growth rate of 15% over the same period. So, what makes Canada such a hub for technological innovation that is attracting increasingly more venture capital?

Source: Pitchbook.

Canada has been, and will continue to be, a hotbed for venture capital tech investment through the fostering of an entrepreneurial ecosystem that is built to reward innovation, has ample high-skilled talent and provides support for those individuals who are looking to make the initial leap from idea to reality.

Competitive and Simplified Tax Regime

Firstly, Canada has an extremely competitive and simplified tax regime. According to PwC and World Bank Group’s 2017 Paying Taxes report, it found that small to medium-sized Canadian companies make 8 annual tax payments vs. the global average of 25 payments per year and take 131 hours to comply with tax requirements vs. the global average of 251 hours. Additionally, the same report found Canadian corporations on average pay the lowest tax rate of any of the G7 nations. But aside from its overall efficiency and competitive tax rates, there exists many tax credits geared towards technological development and innovation at both the federal and provincial level, as well as geared towards venture capitalists.

Scientific Research and Experimental Development (SR&ED) Program

On an annual basis, the federal SR&ED program provides C$3bn in tax incentives to 20,000 applicants and comes in the form of either an income tax deduction/credit or a cash refund exclusively for Canadian-controlled corporations. The program is Canada’s largest R&D program and is available to companies of any size that perform eligible research activities within Canada.

British Columbia’s Small Business Venture Capital Tax Credit

Investments made into either a registered venture capital corporation (VCC) or an eligible business corporation (EBC) in the province of British Columbia will yield a provincial income tax credit that can be carried forward for up to four years. Individual investors are entitled to a 30% refundable tax credit, up to an annual maximum of $60,000, while corporate investors are entitled to a 30% non-refundable tax credit, with no annual limit.

Québec’s Development of E-Business Tax Credit

The Development of E-Business tax credit is aimed at the development of information technologies throughout the Province of Québec. The tax credit is equal to 30% (24% refundable, 6% non-refundable) of the salaries paid by the corporation to eligible employees to an annual maximum of $25,000 per eligible employee.

Ontario Innovation Tax Credit (OITC)

The OITC is a refundable tax credit calculated as 10% of qualifying SR&ED expenses that include 100% of current expenses and 40% of capital expenses, upwards to an annual maximum of $300,000.

The provincial innovation and venture capital tax credits mentioned are but a few examples from Canada’s largest subnational economies and there exists many more nationwide at the provincial level. We here at Sampford have seen firsthand the importance of these tax benefits and see on a regular basis their existence being the difference between profitability and unprofitability for early as well as mid-stage startups, while for more later stage startups, act as a continued incentive to work and invest domestically within Canada and further cultivate the domestic tech scene.

Globally Recognized Talent Pool

Secondly, the Canadian tech talent market is a global leader. The country boasts over 2.8 million STEM graduates and has the OECD’s most highly educated workforce, with 58% of the 25-64-year-old population having a university or college level education. Also, according to the OECD, Canada is ranked as the #1 most attractive country for entrepreneurs. Human capital lures venture capital and Canada has developed an extremely high-skilled workforce.

Source: OECD.

World Class Universities

As stated, Canada has the most educated workforce among OECD countries and has some of the highest ranked universities in the world with more than 60 universities being home to business incubators, accelerators and start-up programs. The results of all these efforts are seen regularly in the venture capital markets with recent FY2020 8 figure capital raises coming from university-founded companies BenchSci, Fusion Pharmaceuticals and Aspect Biosystem.

Regional Tech Hubs

The Toronto-Waterloo corridor is a global center of talent, growth and innovation, with the 100km stretch representing the second largest technology cluster in North America. The region has 15,000 tech companies, 200,000 tech workers and is home to 5,200 startups, as well as 16 universities & colleges to feed the growing demand for talent. Additional regions of top-ranked tech talent markets include Vancouver, BC, Montréal, QC and Ottawa, ON; all of which are ranked within the top 20 tech talent markets in North America according to CBRE.

Global Skills Strategy

While Canada has a deep and talented workforce, the Global Skills Strategy can be used when you need highly skilled tech talent from abroad to immigrate and help your company grow when local talent isn’t enough. Over 30,000 skilled workers have come to Canada through this strategy and can be processed in as little as two weeks with the 3 top occupations being developers, computer analysts and software engineers.

Public and Private Sector Financing

A final area of differentiation for the Canadian tech scene and another cause of the growing venture capital investment is the existence of public and private sector grants and investments that allow Canadian entrepreneurs to take that initial step in starting their company. While there are a number of crown corporations, educational institutions, incubators/accelerators and industry advocacy groups that help give Canadian entrepreneurs their jump start, we will expand on two of the most influential groups responsible for supporting tech entrepreneurship in the country, Mitacs and Business Development Canada.

Mitacs

Mitacs is a nonprofit national research organization that, in partnerships with Canadian post-secondary institutions, private industry and government, has conducted research and training programs in Canada for over two decades. Mitacs works with 70 universities, more than 6,000 companies, as well as both the federal and provincial governments, and has invested more than $700 million over the last 10 years across thousands of internships and projects, with 22,000 participants having gone through the organization. Mitacs is essential in the continuation of Canadian innovation through their financing of research or internship opportunities, covering up to 55% of the costs, and leveraging of their extensive support network.

Business Development Canada

Business Development Canada (BDC) is a federal development bank structured as a crown corporation with a broad mandate to spur economic development throughout the country through flexible investment and advisory services. BDC actively support 3,000 Canadian tech entrepreneurs with more than C$2bn in loans and investments made without diluting ownership. BDC Capital is a strategic partner to the country’s most innovative firms with separate venture capital, growth & transition capital and growth equity teams

Source: BDC.

In conclusion, it is evident that the fostering of an entrepreneurial ecosystem within the Canadian technology space through the development of a competitive and simplistic tax structure, a deep domestic talent pool with the ability to quickly and easily bring in talent from abroad and access to small capital or research grants for individuals to kick start turning their ideas into realities has been a catalyst for venture capital investment over the last decade.

As we said at the beginning, we think Canada is a pretty great country and has many competitive advantages in the technology space that have been outlined in this post. What was not mentioned in this analysis is the fact that Canada is the least corrupt and second only to Japan in political stability amongst G20 nations, has a sound banking system operating within its borders that made it one of the few developed economies to avoid catastrophe in 2008 and is the #1 ranked country globally in quality of life for its citizens, among many other notable accolades, but again, we told you we were biased.

About Sampford Advisors

Sampford Advisors is a boutique investment bank exclusively focused on mid-market mergers and acquisitions (M&A) for technology, media and telecom (TMT) companies. We have offices in Toronto, Ottawa and the US and have done more mid-market tech M&A transactions than any other adviser.