Sampford's PE Survey Summary

Introduction

In our last blog, we began to present the results of our bi-annual survey, where our VC respondents were showcased, highlighting some key insights and metrics to track. In case you missed it, that blog can be found here.

The next participant group that we’ll be examining is Private Equity, with next month being the Tech CEO’s responses. As an active M&A advisory firm, we maintain an extensive network of Private Equity professionals, allowing for a deep respondent pool to provide these insights.

Respondent Summary

With regards to the respondent base, the table below gives a high-level overview of the participants in the survey.

Some key points of note are the fact that the majority of respondents are American PEs and all invest in software as an investment category. The American private equity firms have been very acquisitive in recent years, specifically in the software / broader tech space, which indicates that the respondents are actively participating in the M&A environment. Additionally, half of the respondents have assets under management (AUM) of > $500mm, indicating that their funds would typically be investing in middle-market assets. These characteristics should all be kept in mind when reviewing the subsequent results. Each PE firm has unique investment preferences and areas of focus.

Key Evaluation Metrics

The chart of key evaluation metrics below offers valuable insight into how these PE firms are currently assessing the performance of their portfolio companies and potential investments, as well as showcasing the same assessments made in our previous survey back in January.

In the same manner as the VC survey, respondents were asked to rank the unique metrics in comparison to the other metrics (score out of 7). So, in this instance, Net Retention was the highest priority in January, and Gross Retention is currently being graded as the most important, while LTV / CAC (lifetime value of a customer divided by cost of acquiring that customer) was of the lowest priority in both cases. These results provide some valuable insight into how private equity firms are evaluating firms in the current climate. From the chart, there is a heavy emphasis on revenue retention stats (to learn more about the difference between the different retention calculations click here), with profitability and cost related figures such as margins and LTV / CAC ranking at the bottom. Strong revenue retention not only indicates a high-quality product, but also implies stability when forecasting future cash flows which is a focal point of evaluating the financial profile of an existing portfolio company or potential investment. Cost centers impacting EBITDA margin, and LTV / CAC are risks that can be mitigated by capitalizing on synergies and are not as impactful as the retention of a company’s revenue. Growth was deemed to be the most important figure in our VC survey, and while it was graded as the 4th highest priority, the three entrants above it are all related to retention, indicating that growth is still a key metric.

Valuation Assessment

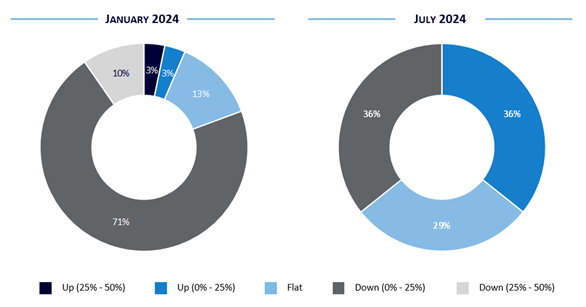

We asked participants to weigh in on what they’ve observed regarding valuations over the LTM (Last-Twelve Months) period, and the chart below outlines the observations from the start of the year, and how they’ve changed throughout 2024.

Valuation assessments back in January were quite pessimistic, with 81% of respondents observing a decline after a difficult M&A market in 2024. However, our most recent results show that only 36% of respondents see a decline, with the same proportion seeing increasing valuations, and the remainder not seeing any material change.

M&A Activity Expectations

We also asked respondents to provide their opinion on how they expect M&A activity to track over the NTM (Next-Twelve Months). The respondents showed enhanced bullishness, as no respondents are anticipating a decrease in deal activity, compared to January where 13% were projecting a decline.

The bullishness regarding deal activity can be justified by the same tailwinds supporting the optimism concerning valuation. We would expect lower interest rates and a decrease in geopolitical uncertainty in the coming months to bolster deal activity as well as valuations over the NTM.

Conclusion

In conclusion, our PE survey was able to provide a snapshot on the perspective of the North American landscape. Gathering their key evaluation metrics, valuation observations as well as their expectations for deal activity into the next twelve months are all incredibly useful data points.

We’d like to thank all the respondents that took the time to provide us with this information.

To see the full results of the PE survey click here.

Thanks for reading, stay tuned for next month’s entry where we dive into the results from our Tech CEO survey, and if you have any questions regarding M&A or any related topics, do not hesitate to reach out!