throughout the pandemic, there are many “pandemic-proof” business models taking flight to all-time highs. Software companies, in particular, were positively affected as Work from Home, EdTech, E-commerce, AdTech, and Cybersecurity all experienced an increasing need when remote working and learning became a necessary reality.

Read MoreSoftware Initial Public Offering (“IPO”) valuations have skyrocketed over the past decade, climbing 430%+ since 2010, with a majority of the gains realized over the past 2 years. On the other hand, Venture Capital (“VC”) investments in the broader software space have always commanded elevated valuation expectations.

Read MoreWhile venture capital investments in the software industry have become increasingly concentrated, it’s important for founders and owners to remember that raising capital impacts the future financial outcomes of businesses. This blog post introduces and explores the concept of capital efficiency.

Read MoreCanada has a fast-growing technology scene that is spread across the largest cities in the country. We were curious to determine which cities are most dominant for the major verticals in technology.

Read MoreSince the pandemic in early 2020, the software M&A market decoupled from the broader M&A market, soaring to all-time highs despite strong economic headwinds

Read MoreThe looming question now is, what happens when electric vehicles make up 30% of the total passenger car market in 2030? Or when solar energy produces over 700 billion kilowatts in the US by 2050? The opportunity for software to play a role in these ever-expanding markets is unlimited.

Read MoreI was recently asked by a journalist why is M&A activity so high in the tech space and if everything is for sale. It sure feels that way sometimes what with so many high-profile companies recently announcing their exits.

Read MoreUnlike 2020’s pandemic, January 2021 was a social network fueled battle against the establishment. It was Main Street vs. Wall Street, inertia vs. fundamentals, the shooter vs. craps.

Read MoreNRR is arguably one of the most fundamental metrics in determining success within your product and it is something that any SaaS company should be tracking

Read MoreIt can be expected that add-on acquisitions will continue to be a predominant strategy for software-focused private equity going forward given the continued competition for attractive platform investments.

Read MoreAs barriers are removed through technology, so are the possibilities for significant national security threats increased. We are starting to see some very interesting reactions take place with the biggest players on the world stage.

Read MoreIn this blog, we look at the current impacts on the VC fundraising market, with one full quarter of data post the state of emergency declaration in the US on March 13th, 2020.

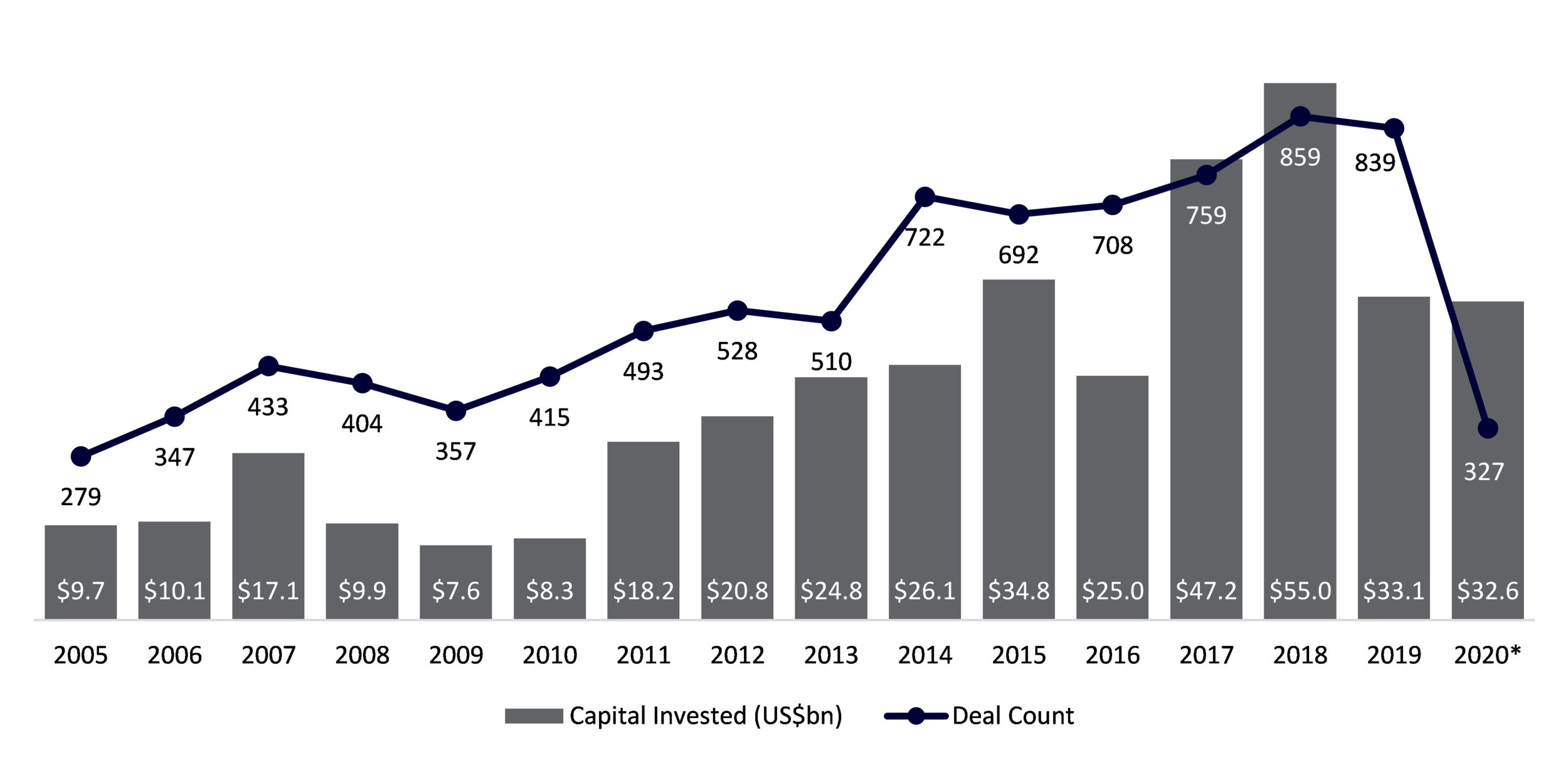

Read MoreOver the past decade a new term in the alternative investment space has seen quite the increase in usage – growth equity (GE). Falling under the umbrella of private capital, growth equity investments are often seen as a middle ground between traditional venture capital and private equity strategies.

Read MoreSome buyers that don’t have sufficient internal M&A resources are buying companies without using an adviser - and we think that many are over-paying as a result!

Read MoreWhen Covid-19 hit North America in earnest in mid-March, its no secret that the M&A market saw a dramatic slow-down in activity. Three months on, and the M&A market has shifted dramatically again, this time for the better.

Read MoreWe spent the last 3 months working from home in quarantine and had to quickly adapt to the challenges that entails. Virtual meetings were no longer a nicety, but quickly pushed to an absolute necessity. From online schooling to general business meetings the world turned to technology platforms that could facilitate the transition.

Read MoreA control premium, simply put, is a premium above the market price a buyer is sometimes willing to pay in order to acquire a majority stake (i.e. > 50%) of a target business.

Read MoreThe adoption of cloud has been one of the most significant trends in the Technology sector over the course of the past decade and a half. Everyone from businesses to consumers would have noticed the shift from on-premise solutions to cloud-based ones for everyday productivity tools like G Suite, One Drive, and Dropbox.

Read MoreWe recently conducted a survey of executive leaders and other industry participants on what they thought the economic recovery might look like. We had over 250 responses, so a pretty good sample size. So, let us dive into the results and what it means for the global economy.

Read MoreCovid-19 has had a dramatic impact on the overall markets and especially the venture capital and M&A markets. And while the market has bounced back significantly from recent lows, many clients are asking what this means for the private markets like M&A and raising VC capital. As such, we keep getting questions from various software companies on what is the best course in these challenging markets.

Read More