Clean Energy Software - Playing Catch-Up?

Over time, we have seen software play catch-up with what is happening in the world. The time lag associated with this catch-up period breeds opportunities for startups, industry adjacent companies, and early-stage investors. The Covid-19 pandemic was the perfect example of this time lag being accelerated by externalities which forced work from home (WFH) software to take the spotlight amongst investors. This allowed WFH software to gain significant attention and growth that it otherwise would have taken years to achieve.

To put some numbers behind this, from January 2020 to June 2021 there have been 19 publicly announced rounds of funding and buyouts in the WFM space when compared to only 5 in the year prior, and 43 since 2000[2]. The same trend could be applied to almost any software vertical as industries mature and require more and more applications to operate but over a much longer period.

The looming question now is, what happens when electric vehicles make up 30% of the total passenger car market in 2030?[3] Or when solar energy produces over 700 billion kilowatts in the US by 2050?[4] The opportunity for software to play a role in these ever-expanding markets is unlimited. We will need applications to run analytics on charging stations, programs to help consumers get rebates on their energy sources, software to manage and transition of local power grids, and this list is only scratching the surface of possible applications.

Most software that exists today is future-proof and mission-critical to their customers. This is exactly the approach that new firms in the clean technology space must take today if they wish to succeed in a market that is just materializing. No doubt there will be industry adjacent firms hoping to tackle these challenges but currently there exists large gaps and opportunities for new players to emerge in this space.

Diving Deeper into Subsectors

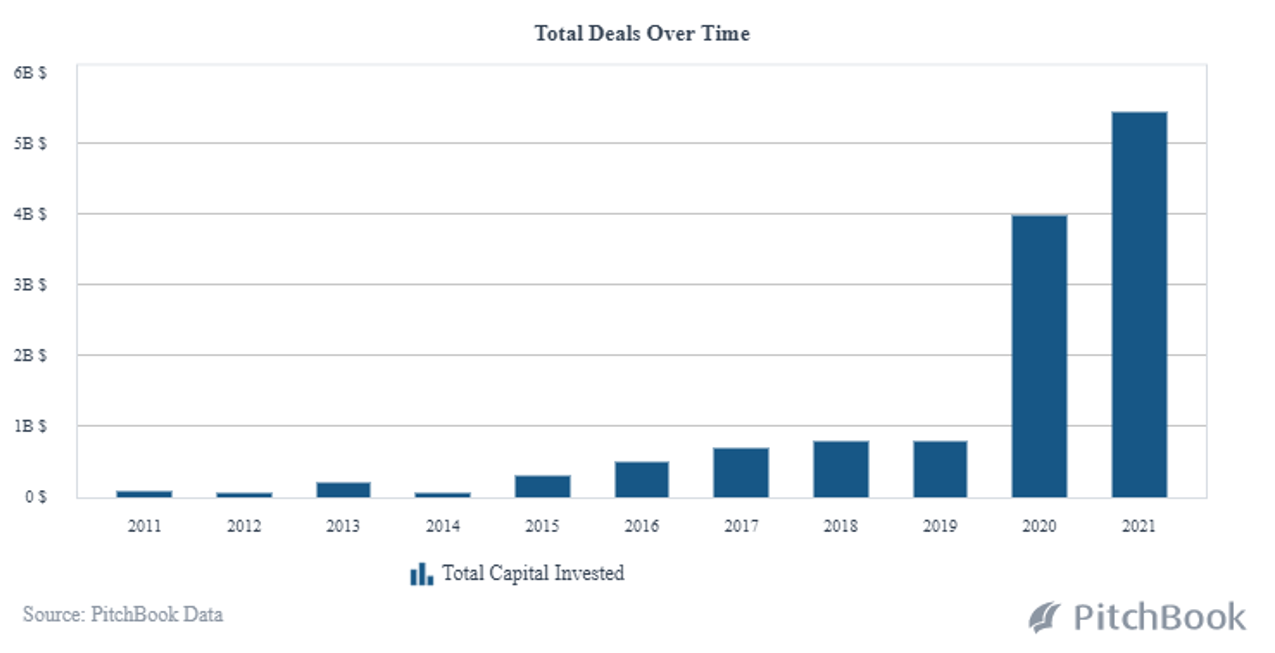

Just by screening a few subsectors within clean technology, we can see that markets exist for clean technology software and that investor appetites for these companies are growing. The below chart shows the amount of capital invested in smart grid technologies which help coordinate a more efficient flow of energy from utility companies to end consumers:

Similarly, the electric vehicle infrastructure subsector, although not directly associated with software, has experienced an even stronger interest:

Promises of USD$2 trillion investments in renewable energy infrastructure from the Biden administration combined with an increasing investment of private capital from institutional investors, private equity funds, and other capital providers will drive the growth of all types of alternative clean energies.[5] Circling back to the time lag that we often see in software we now must ask ourselves; how quickly will software respond to this growing market?

How & Where Will the Market Materialize

Government support, private market interest, changing consumer behavior, and general awareness will drive the timing and adoption of clean technologies. Clean technology software will play a large role in bridging the gap between the accessibility and the ability for clean technology companies to scale up their operations and manage their firms efficiently. As shown in the chart below, since 2015, SaaS within the clean technology space is severely lagging in terms of capital investment (USD$400 million):

Although the SaaS response is still lagging when compared to other verticals in clean technology it has significantly improved in the past 6 years. To showcase this time lag response the below chart will show the amount of capital invested in clean technology SaaS for a similar 6-year period from 2009-2015 which shows a significant decline from the 2015-2021 levels (USD$130 million):

Although it is not as obvious as WFH software’s accelerated growth, clean technologies will require all different types of software applications to monitor, operate, and succeed in the future.

When it comes to geography, North America is leading the charge in the clean technology space as both US and Canadian governments have provided significant financial support for their startups and firms. As recently as February 2021, the Canadian government allocated CAD$55.1 million to support R&D on 20 clean technology firms.[6]

Therefore, it is highly likely that clean technology software will follow a similar trend and develop from North America unless there are unforeseen externalities that would shift this trend to another geographic area.

Final Thoughts

This article only begins to attempt to understand a very complex market that is in the early stages of development. The number of applications that are possible when combined with other technologies that are still currently developing, such as IoT and AI, could even further the need for software integration within the clean technology space. Other existing industries such as Agriculture could also significantly benefit from clean technology and resource management software that was not even discussed within this article. Another possibility is that hydrogen energy, nuclear, or other forms of alternative energies may play a larger role in the future than originally expected. With all these potential unknowns one thing that is almost certain is that there will be a need for software to help manage the future of clean technology.

Written by Andre Breton of Sampford Advisors.

[2]Source: Pitchbook

[3] Source: Electric vehicle trends | Deloitte Insights

[4] Source: Forecast of electric generation from solar PV in the United States 2050 | Statista

[6] Government of Canada invests in Canadian clean technology innovations (newswire.ca)