Work From Home (“WFH”) Technology – Corporate Offices Succumb to COVID-19

Introduction

As the world starts to slowly open back up, we take this opportunity to look at how COVID-19 impacted technology and corporate workforces. We spent the last 3 months working from home in quarantine and had to quickly adapt to the challenges that entails. Virtual meetings were no longer a nicety, but quickly pushed to an absolute necessity. From online schooling to general business meetings the world turned to technology platforms that could facilitate the transition. Despite what has been volatile markets, some of the best positioned technology business have shined for investors.

On the flip side of that coin, we have also seen some high-profile collaborative workspaces, most notable WeWork, have their troubles compounded. We are not seeing the reversion to “normal” as quickly as we converted to COVID-19. In fact, many businesses used the opportunity to re-evaluate their corporate workforce policies. As collaborative technology platforms soar, another victim of the global pandemic will likely be corporate offices and commercial real estate.

Strong Performance from Collaboration Providers

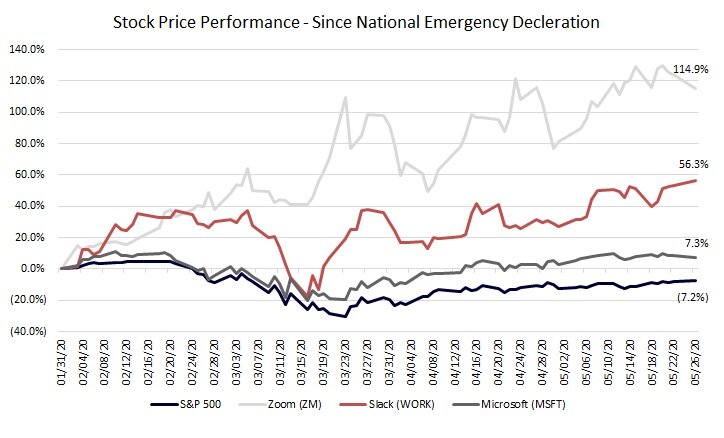

Looking at an indexed price performance of the S&P500 relative to the some of the most widely used collaborations platforms year-to-date paints an interesting picture. As the general market fell-off and has only slowly recovered (down 7.2% YTD), phone and video conferencing solution Zoom is up over 100%. Despite fiercer competition in the general collaboration software space, Slack is up over 50% YTD and is close to its IPO listing price again. Lastly, despite a much more diversified product mix, Microsoft is up over 7% as it continues to grow its Teams business.

Source: Yahoo!

Obviously, the current necessity of working from home has been driving these strong returns, so the question becomes do the platforms remain strong after COVID-19? Slack will still face strong competition from Microsoft Teams, which had reached 20 million active users before the pandemic, but the general consensus is whether it is in office or at home, the collaboration software space will continue to grow. If you combine that with a more fundamental shift in corporate working policies, all of these platforms are likely positioned well moving forward.

Major Technology Firms Move to Permanent WFH Strategies

Looking to the future and a post-COVID-19 return to work, we have seen some interesting announcements from some of the largest technology firms that there might not be a return. Mark Zuckerberg recently indicated that as much as 50% of the Facebook work force could be shifted to WFH. Twitter also announced that it will continue to allow some of its workforce to WFH “forever” if they choose. Shopify CEO Tobi Lutke tweeted “Office centricity is over. As of today, Shopify is a digital by default company.” While not all companies will make such drastic changes to their work policies, and there are still lots of dollars being spent on corporate office locations and expansions, the WFH concept is certainly here to stay.

It is still too early to gauge the impacts of the WFH transition on commercial real estate generally, as the market tends to lag the economy by at least 6 months, but protracted impact to tenants businesses will not be helpful in the short term. In the medium-to-long term commercial real estate will likely adapt to a new type of demand by retrofitting existing locations. One high profile player, WeWork, may not be so lucky as it faces a protracted cash burn. The company failed to secure a $20bn float before the pandemic hit and now there is questions over whether SoftBank will proceed with its cash injection to save the business.

Regardless of what happens corporate offices and the commercial real estate market will be forever altered by COVID-19.

Written by Mike Lambrix of Sampford Advisors.

About Sampford Advisors

Sampford Advisors is a boutique investment bank exclusively focused on mid-market mergers and acquisitions (M&A) for technology, media and telecom (TMT) companies. We have offices in Toronto, Ottawa and Austin and have done more mid-market tech M&A transactions than any other adviser.