The Upcoming Recession – How to handle a bear market

With all the major indices now firmly in bear market territory, many of the major economists around the world are predicting a global recession. While we’ve been expecting something like this to end the long bull-run we’ve been experiencing, none of us expected the market to turn so quickly.

In this blog we look at what we would expect in the coming months and how best to prepare for a recession, which seems inevitable at this point.

Expect Continued Volatility

It’s certainly been a bit of a wild ride over the last few weeks with massive swings in the market in both directions. Until the market knows more about Covid-19 and its true impact on the economy, we would expect these swings to continue. If you look at 2008 as the example, market volatility really began to increase in September of 2008 and didn’t meaningfully subside until June of 2009 – so a full nine months for the market to come to grips with the rapidly evolving situation. We would expect this cycle of volatility to be a little shorter but still expect it to last at least 3-6 months.

Source: Yahoo!

Economic activity will decline for 2+ quarters

If we refer back to 2008 again, the recession went on for four full quarters before economic growth started again. This time around most economists are calling for the next two quarters to be negative (1Q and 2Q) before a recovery in the second half. However, the only thing that can be guaranteed is that the economists don’t know for sure. Having said that, we would expect the contraction in GDP to coincide with the virus spread and most doctors believe the virus will subside by summer – similar to the seasonal flu. At that time, travel and entertainment should resume and hopefully lead to a recovery in the third or fourth quarter.

Source: Bureau of Economic Analysis.

You need to take measures that extend the runway

We have already heard from companies that they are already seeing troubling leading indicators on their businesses and are therefore taking actions to significantly reduce expenses. Obviously, the leading edge of this is anyone in the travel and tourism industry but its also beginning to show up in tech as clients evaluate budgets and determine if certain software they are using is “critical”.

We also hear from many tech CEOs that they only have 6-12 months of cash runway and that if sales drop through increased churn, that this could shorten even further. So, what should you do? Having a plan and acting swiftly is often the best idea. Many companies have frozen new hiring initiatives and others have already begun laying off employees. These are tough and emotional decisions for anyone to make but unfortunately to preserve the business for everyone that is left, is often just as critical.

VC funded companies should raise now!

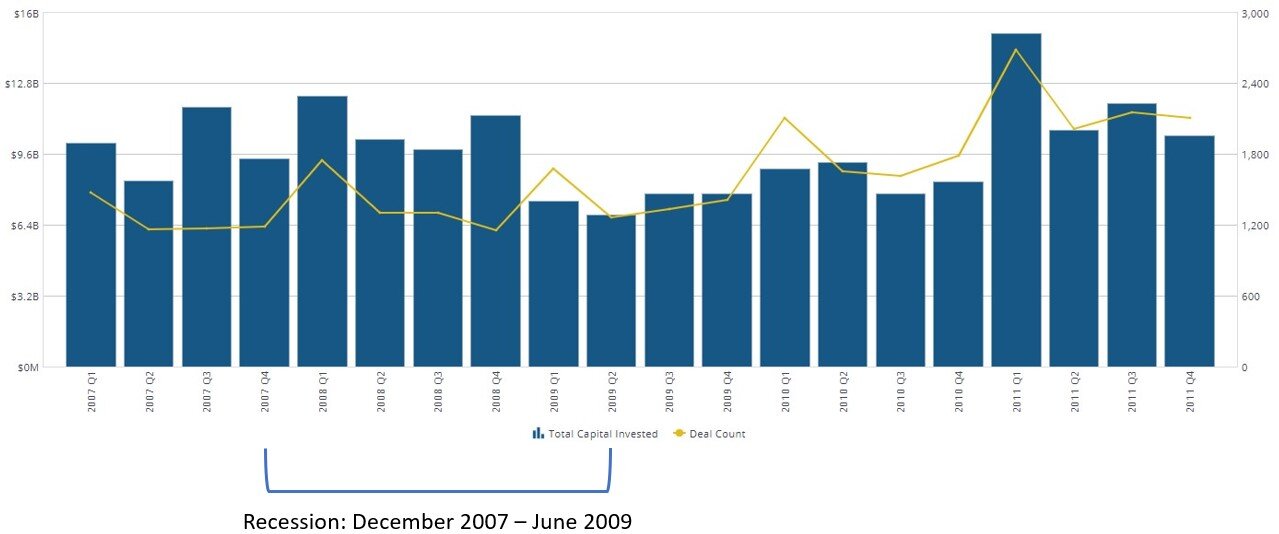

If we take a look at the last recession, it took a while for the VC market to catch up with the broader markets and economy. Even though the last recession started in December of 2007, the drop off in VC activity in terms of the dollars deployed didn’t drop until 1Q09. After this it took until the first quarter of 2011 for activity to increase again – so there were eight full quarters of decreased activity!

Source: Pitchbook.

So, if you’re a VC backed company with less than 12-18 months of cash left on the books, we would still highly recommend that you try to raise the capital immediately to extend the runway out for more than two to three years. No one has ever regretted raising too much capital, especially in times like these and even if that capital is raised in a down round. The companies that did this in 2007 and 2008 might have felt like it was painful at the time but post crisis it made them stronger and more prepared than their competitors.

M&A will be slow but recover next year

In the last downturn, M&A dropped quite quickly and remained at depressed levels (down 20-40%) for a number of quarters. It really wasn’t until 8-10 quarters had passed that M&A really returned to its prior run-rate (see chart below). We believe that this time the shock to the system should be shorter and if we get the economic turnaround in the second half of this year that we talked about earlier, then we should see M&A start to pick-up again and see a return to normal deal closings in the first half of 2021. Having said that, strong companies with good financial profiles and sticky customers will still be able to get deals done at attractive valuations as they will be more highly differentiated than ever, versus the rest of the market. And on the other end of the spectrum there will also be plenty of distressed M&A as sub-scale businesses merge to survive or take any M&A offer than can get rather than go out of business.

Source: Pitchbook.

This should create opportunities – less well funded companies will close

As with any contraction, there are always opportunities for those who are prepared. Either that will be in the form of buying a weaker competitor, getting top talent that you previously couldn’t attract or building a bigger customer base as competitors wane. But all of this requires you to be in the best financial position to be able to benefit from this – so focus internally first to make sure you have a robust plan on how you’re going to get through a potentially protracted downturn.

About Sampford Advisors

Sampford Advisors is a boutique investment bank exclusively focused on mid-market mergers and acquisitions (M&A) for technology, media and telecom (TMT) companies. We have offices in Toronto, Ottawa and Austin and have done more mid-market tech M&A transactions than any other adviser.