1Q17 Tech Exits – IPOs and M&A Remain Strong

Also published in VentureBeat (https://venturebeat.com/2017/04/10/tech-exits-in-1q17-ipos-and-ma-remain-strong/)

The first quarter of 2017 was another good quarter for technology company exits. We saw a number of very high profile tech company Initial Public Offerings (IPOs) come to market which is extremely encouraging given the limited activity we saw in 2016.

On the merger and acquisition (M&A) side of things we saw an equally positive trend with the number of technology M&A transactions coming in at 638 for the quarter, a healthy increase over the prior two quarters.

In this article, we breakdown the first quarter technology IPO and M&A markets in North America in more detail and describe what I believe it means for the year ahead.

Technology IPO market

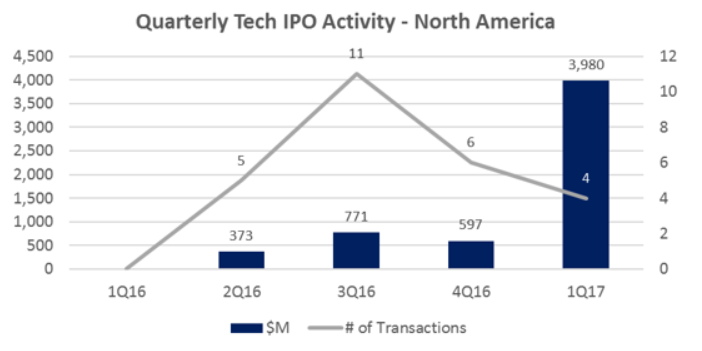

As you can see from the chart below, IPO $ volume increased significantly in the first quarter with nearly $4bn of IPOs pricing in the quarter. Obviously much of this was driven by Snap’s $3.4bn IPO but it is still encouraging for the tech IPO market as a whole given the limited volume of new technology company issuance we have seen over the preceding twelve months.

Above: Data Source: CapitalIQ.

A closer look at the four tech IPOs in the first quarter shows another important trend - all of the IPOs have made investors money – on average they are up 22% since IPO. This is important because it means tech IPOs as an “asset class” are outperforming the broader markets and therefore encouraging investors to invest in future IPOs. This can be seen in the table below.

Above: Data Source: CapitalIQ, SEC.gov.

Given this performance, we would expect the IPO markets to be just as robust for the rest of the year as public-market investors continue to look to outperform the broader markets and Venture Capitalists look to continue exiting their better-performing portfolio companies.

Technology M&A Market

The technology M&A market continues to remain extremely robust with $28.1bn of transactions being completed in the first quarter. While this was down from the $86.4bn in the fourth quarter, the overall number of transactions was up from 599 in 4Q16 to 638 in 1Q17 – the delta in overall value was driven by the fact that the fourth quarter had several blockbuster transactions like CenturyLink’s acquisition of Level3 for $25bn.

Above: Data Source: CapitalIQ.

All-in-all we are very encouraged by what we are seeing in the M&A market as the number of transactions is up for the second quarter in a row and there was year-over-year growth in the $ volume of transactions too. We are also encouraged by many of the positive macro factors that continue to fuel the M&A market including large corporate cash balances, slowing organic growth and a relatively strong equity market. These factors should remain in place for much of 2017 and in my opinion will likely lead to another record year for technology M&A.

About the Author

Ed Bryant is President and CEO of Sampford Advisors, an M&A advisory firm for Canadian technology companies. Ed has over 20 years of experience, including over 17 years in investment banking with Deutsche Bank, Morgan Stanley, and Sampford in Hong Kong, Singapore, New York, and now Ottawa. In that time, he has raised in excess of $20 billion in equity and debt capital and completed over $10 billion in M&A transactions.